The global minimum tax is a matter of great concern for both the international investor community and the host countries. As a destination for significant foreign investment, Vietnam is expected to be significantly affected by the implementation of the global minimum tax, especially in terms of investment promotion, incentives, and support for foreign investors. The global minimum tax is expected to come into effect at the beginning of 2024, and Vietnam needs to quickly implement measures to respond and mitigate the adverse impacts of this new mechanism.

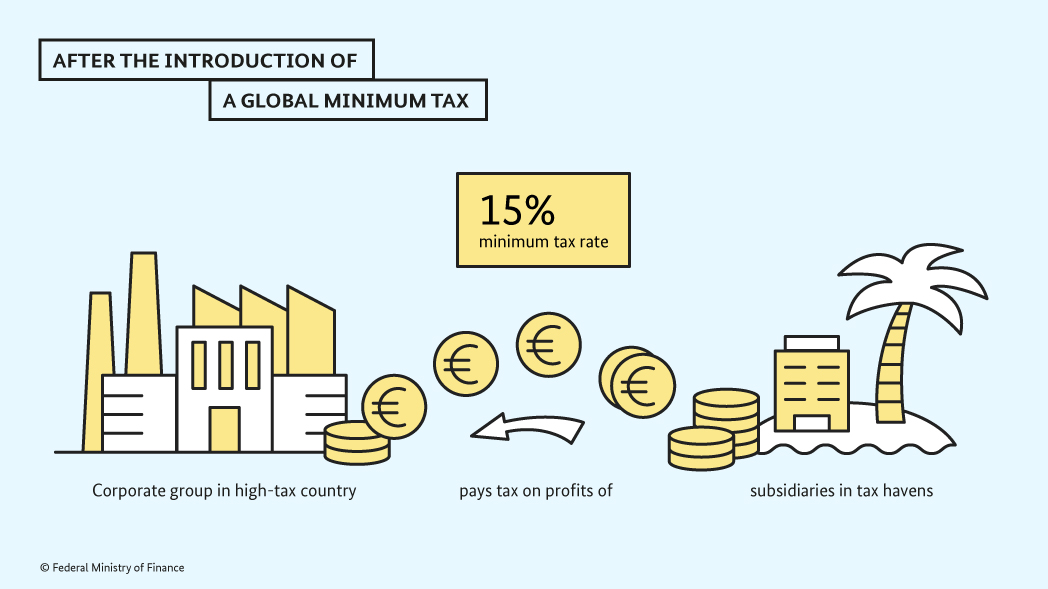

The Global Minimum Corporate Income Tax (commonly referred to as the Global Minimum Tax) is one of the two main pillars of the Base Erosion and Profit Shifting (BEPS) Action Plan initiated by the Organization for Economic Co-operation and Development (OECD) in June 2013. The global minimum tax rate is set at 15%, applicable to multinational companies with total consolidated global revenue of at least EUR 750 million (USD 800 million) in at least two of the four most recent consecutive years.

Based on BEPS, the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (MLI) was developed in 2016, attracting participation from 141 countries, including Vietnam. According to the plan, the MLI will come into effect at the beginning of 2024, which also means that the global minimum tax will be applied starting next year. However, the implementation of this mechanism requires approval and specific deployment in each member country.

So far, the European Union (EU) and South Korea have approved plans to implement the 15% minimum tax rate from January 1, 2024. Several countries supporting this mechanism are also in the process of implementation to apply the global minimum tax next year. Specifically, Japan is drafting the 2023 Tax Reform Bill, and Switzerland is conducting a referendum on this policy in June 2023. Some Southeast Asian countries like Malaysia, Indonesia, Thailand, etc., are also adjusting their tax policies to continue attracting foreign investors if the new mechanism officially takes effect.

In addition to the supportive opinions, the implementation of the global minimum tax has also faced opposition from some countries around the world (particularly China), concerned that this tax policy will significantly affect their competitiveness in attracting FDI.

As a member of the MLI (since February 2022), Vietnam will implement the global minimum tax mechanism from January 1, 2024. The global minimum tax is expected to bring both positive and negative impacts on Vietnam's economy.

The most significant adverse impact is that Vietnam’s competitiveness in attracting FDI may decrease due to changes in tax policies. Currently, Vietnam is applying various tax incentives for foreign investment enterprises, including (i) preferential tax rates (10% for up to 15 years and 20% for up to 10 years); (ii) temporary tax exemptions and reductions (up to 9 years); (iii) allowing loss carryforward when calculating taxable revenue (within 5 years); (iv) exemption from tax on overseas profit remittance; (v) tax refunds for reinvested profits; (vi) allowing accelerated depreciation, and other tax incentives and land rental reductions. These tax incentives help reduce the effective corporate income tax for FDI enterprises to just 12.3%, and some large corporations only pay tax rates of 2.75% - 5.95%.

When the global minimum tax is applied, large multinational companies investing in Vietnam will have to pay the difference to reach the 15% rate to their home countries, thus the tax benefits they previously enjoyed or could have enjoyed in Vietnam will no longer be available or will be significantly reduced. Clearly, this diminishes the tax attractiveness for major FDI investors in Vietnam and could significantly affect their investment decisions in Vietnam in the near future.

Although the global minimum tax only applies to large multinational companies, to some extent, smaller FDI enterprises that are part of the supply chain of a large multinational corporation may also be indirectly affected. According to a review by the General Department of Taxation, it is expected that about 120 multinational corporations investing in Vietnam (with over 1,000 related enterprises) will be affected if the minimum tax policy is implemented soon.

On the other hand, some assessments suggest that the global minimum tax policy could bring certain benefits to Vietnam’s economy. Firstly, the implementation of the global minimum tax contributes to limiting tax evasion, avoidance, and transfer pricing of multinational corporations in Vietnam. Secondly, this tax could help prevent a "race to the bottom" in preferential tax rates to compete for investment among countries. Finally, to some extent, raising the tax rate to the minimum 15% for enterprises could provide Vietnam with a certain amount of additional budget revenue, thereby gaining resources to implement other forms of support (infrastructure, human resource training, etc.) to compensate for investors who have to bear this minimum tax rate.

Brought to you by MrBeliever.com