Despite a difficult 2021, Viet Nam’s shift from low-skilled, labor-intensive sectors to high-value-added industry continues. Businesses struggle to find affordable labor and a list of Vietnam industrial zone that’s available for investing. However, foreign and high-value-added investors still remain quite optimistic about Vietnam’s long-term development.

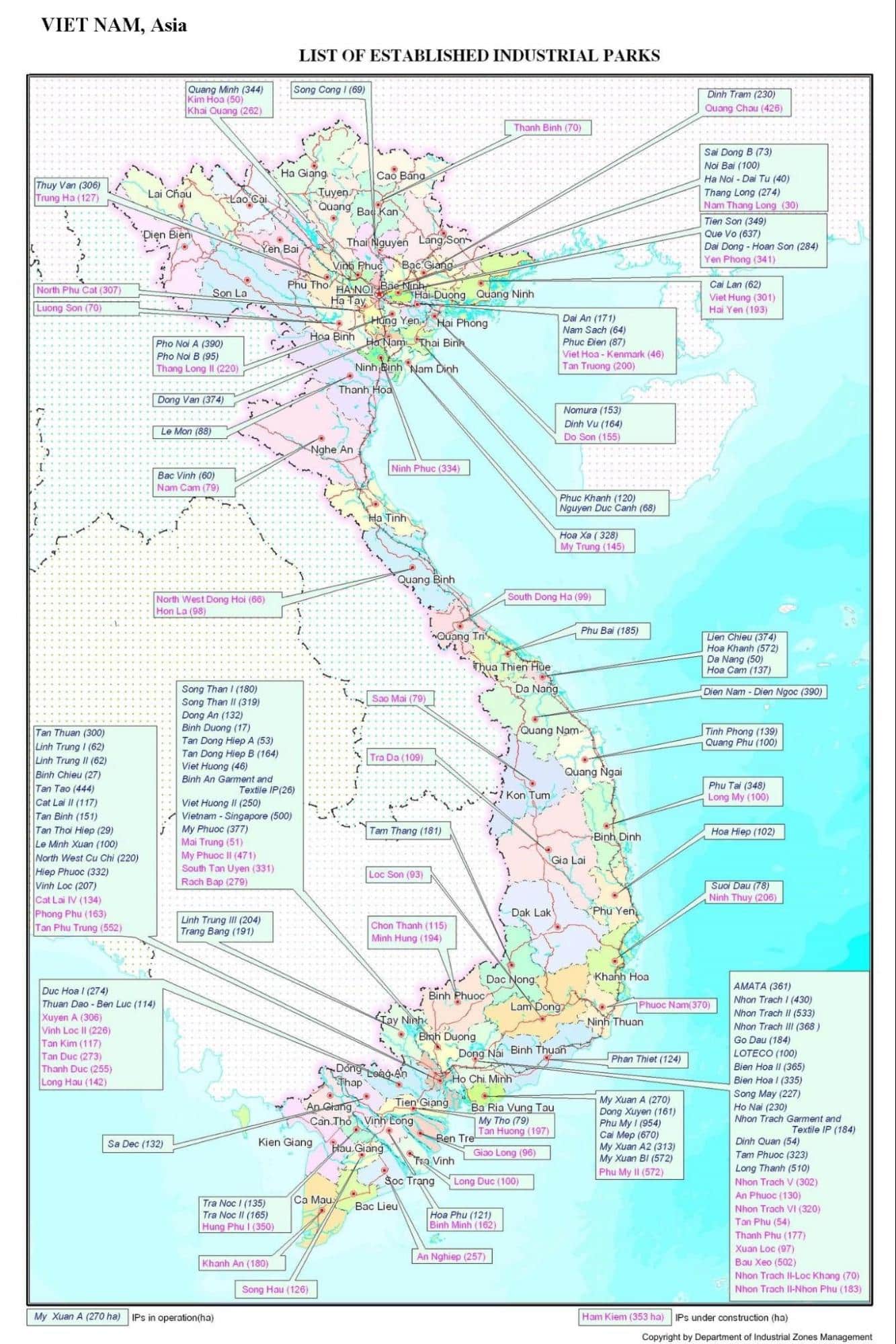

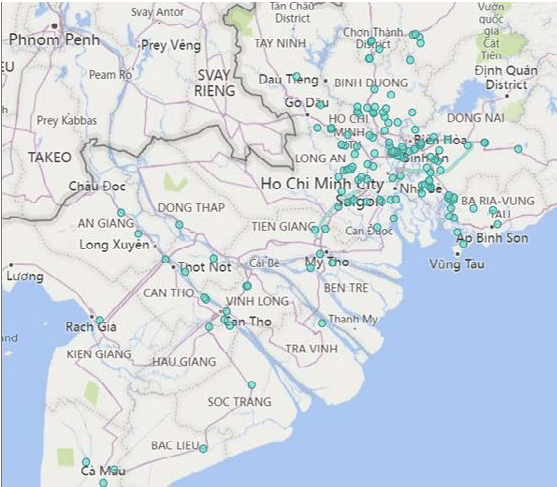

With investors relocating manufacturing to Vietnam, the local real estate market has boomed, with prices continuously increasing. The nation contains 394 industrial parks (IPs) with a total natural land size of 121,900 hectares as of May 2021. There are 286 operating IPs (generating 3.78 million direct employment) with a 71.8 percent occupancy rate, down from 74% last year. H1/2021 saw the establishment of 25 new industrial parks, 19 more than in H1/2020.

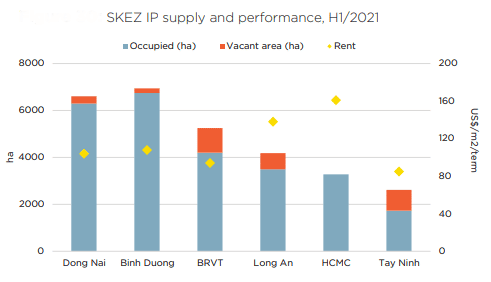

Occupancy rates grew in certain areas while remaining largely steady in others.

The predicted rush of relocations out of China in 2021 has been hindered by lockdowns and travel restrictions. Developers, on the other hand, feel that 2022 will be more successful in terms of leasing; renters and investors will also have a choice of fresh supply after the limitations are abolished.

Dozens of industrial zone projects were authorized in 13 cities and provinces in Q1/2021, offering thousands of hectares to meet future demand. Bac Ninh has the most projects, with five forthcoming IPs, including the 208.54-ha Que Vo III IZ, which has a total investment of US$120.9 million, and the 250-ha Gia Binh II IZ, which has a total investment of US$172.2 million. The 481.2-ha Quang Tri IZ, which has a US$90.2 million investment, and the 529-ha Trieu Phu IZ are two new projects in Quang Tri. Vinh Phuc also anticipates numerous additional developments totaling 500 acres. New developments are also underway in Hai Duong, Vinh Long, Quang Nam, Thua Thien-Hue, Nam Dinh, and Nghe An.

The South will get 6,475 hectares from three more IPs, which will supplement the current overburdened IPs. Long Thanh District would get the 253-hectare Long Duc 3 IP and the 2,627-hectare Bau Can-Tan Hiep IP, while Cam My District will receive 3,595 hectares from the Xuan Que – Song Nhan IP. These intellectual property rights contribute to the country’s 2030 goal, which focuses on the development of high-tech industrial zones.

Long An anticipates a new 119-hectare IP project, Century Industrial Park, planned by Hai Son Co., Ltd., in Duc Hoa District for US$59 million. Long An will have around 1,500 hectares of extra cleared land in its IPs to capitalize on Viet Nam’s rising FDI inflow in 2021. The province’s largest foreign investments are concentrated in textiles and apparel, footwear, animal feed, poultry, fish, food processing, beverages, and manufacturing.

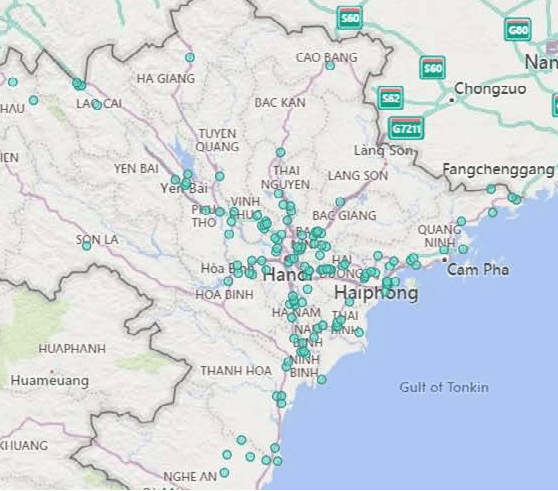

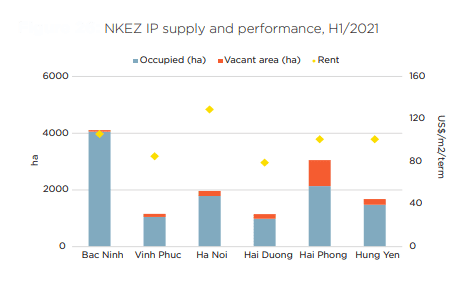

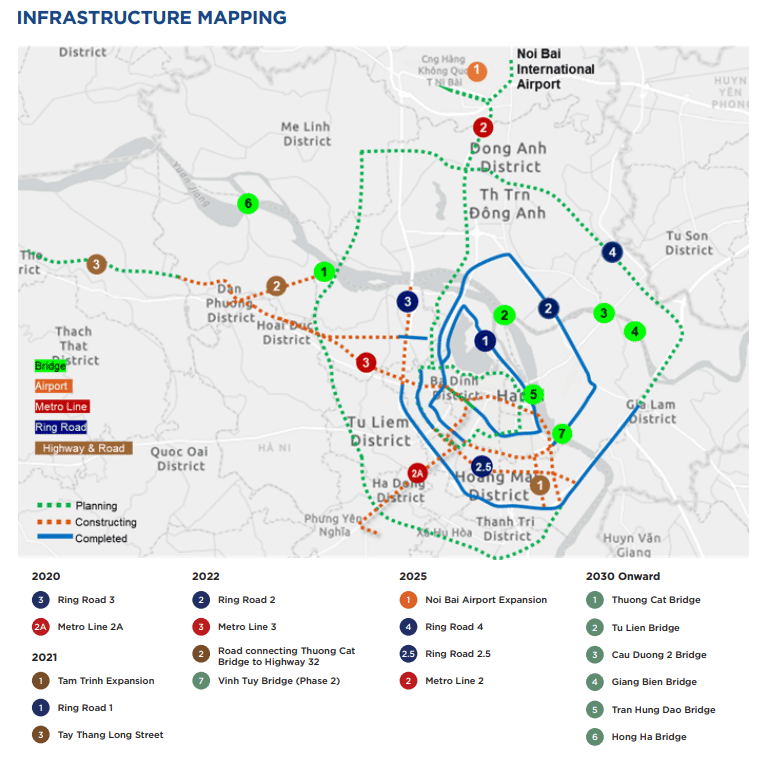

The North Key Economic Zone (NKEZ) includes the provinces of Ha Noi and Bac Ninh, as well as Hung Yen, Vinh Phuc, Hai Duong, Hai Phong, and Quang Ninh. The NKEZ includes well-developed transportation networks, ideal industrial land that is backed by new infrastructure development, China’s proximity and investment, and a concentration on heavy industries, electronics, and large-scale projects.

Occupancy rates rose in certain areas but stayed steady in others. In 2021, the average occupancy rate in Bac Ninh was 99%, 91% in Ha Noi, 88% in Hung Yen, 86% in Hai Duong, and 70% in Hai Phong.

North Vietnam industrial park investors gain from access to utilities as well as regulatory help that ensures operations run at maximum capacity. For enterprises looking for rapid alternative sources of production, the ability to acquire ready-made factories and tap into Hai Phong’s highly skilled labor pools ensures that operations can be built and staffed on time. Exporters benefit from proximity to Cat Bi International Airport, the recently built Highway 5, and the Chinese border.

Unconditional tax holidays give direct cost savings possibilities that may be reflected into expenses immediately for enterprises interested in fully exploiting Vietnam’s cost competitiveness.

Thua Thien Hue, Da Nang, Quang Nam, Quang Ngai, and Binh Dinh are the five cities/provinces that make up the CKEZ. Food processing, textiles, building materials, and paper and forest products are the primary industries in this region. Although sectors such as oil and gas, shipbuilding, logistics, and other high-tech industries are expected to grow rapidly in the next few years.

Investors in the industrial zone benefit from infrastructure and facilities designed to satisfy the demands of Vietnam’s rapidly expanding sectors, such as textiles and electronic components. Water, power, and financial services are all included in this. Da Nang, the economic center of the Central region, provides a regular supply of skilled workers to CKEZ and offers high quality factory for rent in prime locations.

It is possible for foreign investors to get up to five years of tax exemptions on all fixed assets and other materials required to the maintenance of equipment used to produce items in the zone. Foreign investors no doubt have taken note of these benefits.

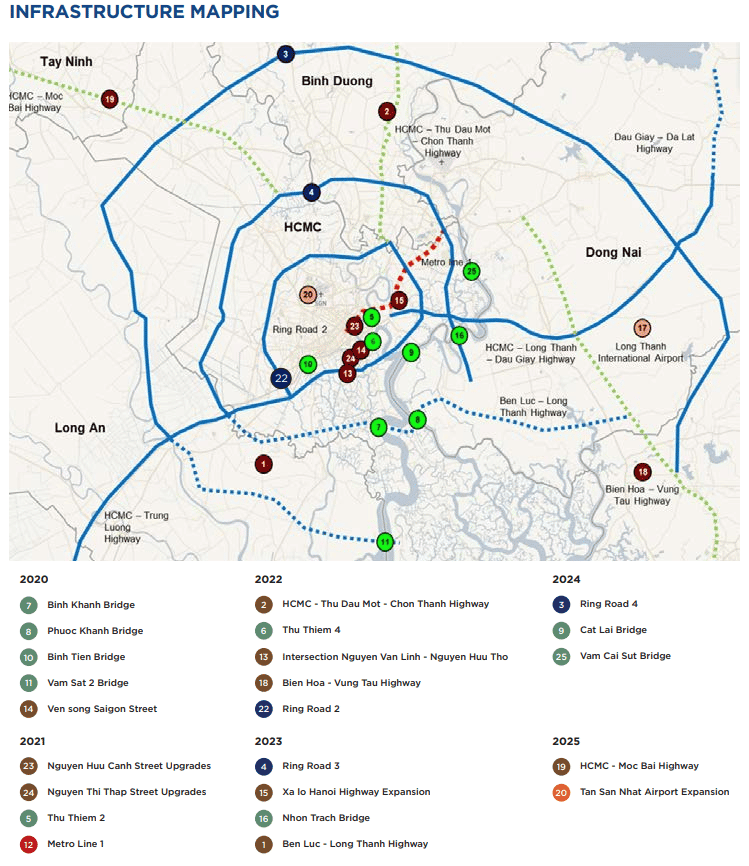

This zone encompasses the provinces of Ba Ria-Vung Tau and Binh Duong as well as the cities of Ho Chi Minh City, Dong Nai, Long An, Tay Ninh, and Long An.

There are several benefits to investing in SKEZ, including its closeness to HCMC, Vietnam’s economic hub, Cat Lai Port is located inside the city borders of HCM, and there is a ready supply of qualified workers from reputable educational institutions.

Industrial, commercial, and residential facilities are seamlessly integrated into Vietnam industrial park to fulfill the demands of a wide range of investors. An onsite customs office, prefabricated factories, and a trained staff from the Vietnam-Singapore Vocational College are all available to investors in the park.

Occupancy rates rose in certain provinces, as they did in the North, but remained consistent across the board. Occupancy rates in 2021 will be as high as 99% in HCMC, 95% in Dong Nai, 90% in Binh Duong, 84% in Long An, and 80% in Ba Ria-Vung Tau, on average.

Additionally, these services are supported by their closeness to Ho Chi Minh City, Tan Son Nhat International Airport, and several places of sea-based transportation, such as Saigon Port.

Investors may save on transportation costs by being close to HCMC and the key south ports, and they can also take advantage of the highly qualified workforce in HCMC.

Source: Savills