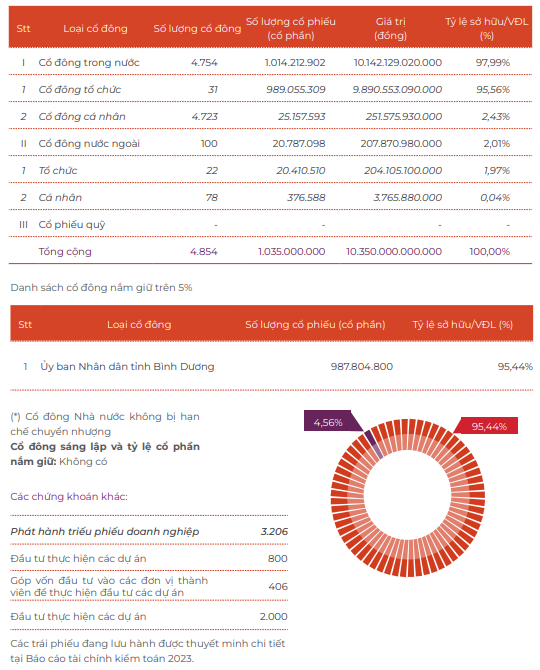

Vietnam’s industrial sector is entering a new phase of growth, and one of the key players shaping this transformation is Becamex IDC. For decades, the company has been a state-backed powerhouse, with the Binh Duong Provincial Government holding 95.44% of shares. Well, That’s about to change! Becamex IDC upcoming public auction of 300 million shares, valued at VND69,600 per share, is set to raise approximately $900 million—making it the largest public share offering in Vietnam’s stock market history. But beyond the headlines, what does this actually mean for us—the developers, contractors, logistics providers, and business owners who operate in this industrial space every day? Let’s break it down.

For years, Becamex IDC has been at the heart of Vietnam’s industrial expansion. If you’ve been involved in industrial projects in Binh Duong, Binh Phuoc, or VSIP (Vietnam-Singapore Industrial Park), chances are you’ve worked on or alongside Becamex developments.

Now, with $900 million in fresh capital, Becamex is fueling their next phase of industrial growth.

If you’re a developer, contractor, or supplier, this auction could translate into new industrial park expansions, more infrastructure projects, and long-term business opportunities.

If you’re a logistics provider, an increase in industrial land means more factories, more tenants, and ultimately more goods moving through supply chains.

If you’re in consulting or design, the companies investing in these parks will need specialized expertise to optimize their operations.

The $900 million capital raise will be strategically deployed across three critical areas:

📍 VND6.3 trillion ($250 million) will fund the expansion of Becamex IDC’s industrial parks, specifically:

➡️ For those in construction and infrastructure, this means more tenders, more contracts, and a larger industrial footprint to support Vietnam’s growing manufacturing sector.

📍 VND3.63 trillion ($144 million) will be injected into Becamex IDC’s key affiliated companies, including:

➡️ If your business involves industrial energy solutions, design consulting, or facility management, these expansions could open doors for new partnerships

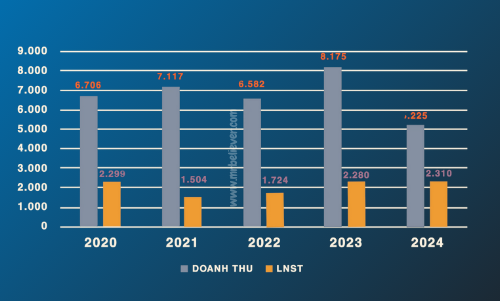

📍 Despite showing impressive profit after tax, BECAMEX IDC are still a heavily indebted business.

Therefore, VND5.06 trillion ($200 million) will be used for financial restructuring, specifically:

✔️ Increased corporate governance & transparency: The shift toward a market-driven structure is expected to improve operational efficiency and accountability.

✔️ Greater foreign investment potential: A more diversified ownership structure makes Becamex IDC more attractive to institutional investors and private equity firms.

✔️ Alignment with Vietnam’s privatization push: The government’s decision to reduce its stake aligns with Vietnam’s broader strategy to reform and modernize its state-owned enterprises (SOEs).

Becamex IDC’s industrial parks play a pivotal role in Vietnam real estate industry. The confidence shown by them in pursuing this large-scale share auction suggests that the company anticipates a favorable market reception, which can be a barometer for overall investor sentiment in Vietnam and its capability to attract foreign direct investment.

This will bring new investments into industrial parks, fueling growth in construction, logistics, and supply chains.

Vietnam’s government has actively prioritized industrial growth, and Becamex IDC is a core player in this strategy. For years, The high percentage of government ownership (over 95%) has reflected the state’s historical role in the economy of Vietnam. However, the planned reduction to 65% signifies a shift towards privatization and a more market-driven approach, which show the government determination to develop next-generation industrial parks, integrate smart sustainable infrastructure, and foster greater efficiency, competitiveness